Every time I visit a geothermal power plant I can’t stop thinking of the price tags associated with all the machinery inside. The wells alone cost millions, not to mention the turbines, cooling towers, piping, heat exchangers, regenerators, etc. Then you have to pay workers, insurance, and all kinds of other costs. Where does the capital come from? Who foots the bill if it doesn’t work? How do you convince someone to invest in an idea as absurd as, “I want to drill a hole several kilometers deep, then pump extremely corrosive and mineral saturated water to the surface, use it to boil another fluid, spin turbines, and sell electricity.”

I’ve been thinking about risk lately, in part because a banking crisis just hammered Iceland, so risk is a big topic here. Risk constitutes a major tenet of any investment consideration. Below are some pictures I drew; they illustrate concepts I feel are very important to (and very absent from) the current dialogue on energy. Namely, why do we have the energy mix we currently have?

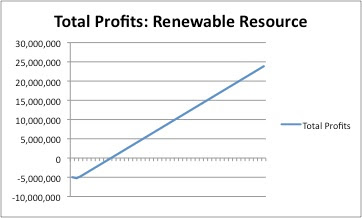

1: Capital Flows in a Renewable Energy Project

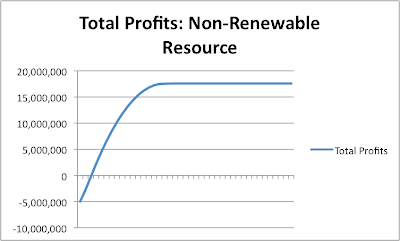

2: Capital flows in a Non-Renewable Energy Project

These graphs (absurdly simplified) compare the costs and revenues of two types of projects. The first describes a renewable energy project like a wind farm. The second describes a non-renewable project like a natural gas well. In this example, both projects start with a $5,000,000 initial investment then fall to a lower level of constant operation and maintenance costs. The main difference is in the shape of the return curves (the operating cost for the renewable plant is also higher, but still flat in this example). These graphs attempt to show the consistent, enduring returns of a renewable resource and the declining returns of a non-renewable resource.

Notice that the bulk of total returns are tipped to the earliest years of the non-renewable project, whereas returns from the renewable project spread evenly throughout time. Gas wells have the highest productivity when they are initially tapped – gas pressures below ground are highest before any gas is removed, then the pressures (and productivity) decline with more extraction until the well is no longer economic to produce. Conversely, the wind will not decline with additional use, so returns remain steady through time. Obviously these curves would wobble and wiggle in real life - this is a theoretical model. Also keep in mind that these graphs do not apply a discount rate to either curve.

So, which picture looks more risky?

Investing is as much about not losing money as it is about making more money. Especially today, investors fear risk. A huge metric is the payback period of an investment – “How long until I get my money back?” The payback period often trumps long-term profits because the fear of loss outweighs the greed of gain. This dynamic often magnifies in a recession.

Your first impression might be that the consistent returns are less risky than the fast bump of cash followed by precipitous decline. However, from a payback period perspective, PPP, (am I an economist now that I’ve coined an acronym?) the natural gas well is less risky because your initial investment is returned more quickly. A lot of the people I interview talk about their investments in this way. They focus on payback periods.

Is this the right way to assess our investments in energy? Obviously the answer is yes for a short-term investor who doesn’t want to lose his or her cash. The risk averse energy investor (read: all energy investors) will generally choose the fastest payback period, which, according to the energy mix of the USA, happens to be a non-renewable resource over 90% of the time. But what is the right choice for a government? How about a government that is concerned by energy security, climate change, and sustainability? A dependable, non-depleting, domestic energy supply probably sounds great to most governments.

Click for video: The New Manhattan ProjectIndeed the American government and many other governments incentivize renewable energy prolifically. Their schemes often defy logic and science. A critical difference between the original Manhattan Project/Apollo Mission and our current energy challenge is that government agencies spearheaded the Manhattan (US Army) and Apollo (NASA) efforts whereas our energy supply is almost entirely produced and controlled by the private sector. Some of my friends at Middlebury may have forgotten this, but we live in a capitalism. The private sector responds to one thing: $$$$. If we want to change the way the private sector invests in energy, we have to change the way they profit from that energy.

Listen to the intro of this podcast: Our last six presidents have failed to deal with the energy crisis despite acknowledging its import.

An effective incentive needs to deal with investors' fear of risk and their desire for quick paybacks - an issue I've never heard addressed by any politician. We've heard of many incentivization schemes. If Obama wants his new Manhattan Project to work then he will need to understand exactly what kinds of incentives the private sector will respond to. Just offering cash rewards like Senator Forbes proposes (above) may not be the ticket. The profit motive might be squashed by the risk fear. One solution is to reduce the payback period on investments in renewables. Here's my idea (and I'd love to know what you think):

1) The government stops taxing renewable energy investment and renewable energy power sales until a project's payback period is reached. 2) The government stops taxing salaries of people employed by renewable energy projects until payback is reached.

Absurd, reckless, outrageous! Ya, but I'm just a kid with a blog, so I get to think big. Even if only 20% of you agree with me, I'm still doing better than congress. Besides, is this any more absurd that a $24 billion dollar bill proposed by Senator Forbes? It's the same idea, just instead of handing you money at the end, the government stops taking your money at the beginning. Timing is everything... Obama and Chu seem like a reasonable team, but they are hardly Oppenheimer and Einstein. I'd rather not have bureaucrats choosing which projects to fund - leave it to the engineers and the capitalists to succeed and fail as they may, then tax the ones that survive after they begin profitably producing renewable energy for the long term.

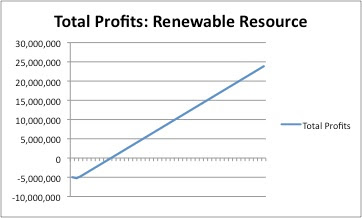

The first piece of my idea should mean that payback happens up to 40% faster. The second piece should mean that renewable energy projects can pay their employees 30% less, but still offer them the same "after tax" salaries, further decreasing payback periods. I think this is a way to address the payback period preference without the messy business of handing out loans, grants, or cash. This tax break would essentially bump up the early revenue streams on renewable energy projects by the tax rate (actually it would lower the cost curve, but the amount is calculated off the revenue curve), thus decreasing the payback period substantially. The attractive long term profits in renewables might also become greater incentives once payback periods shorten to tolerability.

I argue that payback periods matter less to the government than to a private investor because the government has a longer investment horizon, and that this tax break can be viewed as an investment. The private investor wants his money back soon so that he can use it in another project. Theoretically, governments have infinite lifetimes, and they can wait for their money to come back as long as it does come back eventually (with due interest of course). Governments are in the position to make choices on the basis of long-term profits, not payback periods. The tax break is like a loan, which eventually repays, just on a longer time scale. This loan has the added benefit of reducing emissions, "domesticizing" the energy supply, and increasing sustainability - things that matter to government but remain absent in most economic models coming out of private investors' offices.

Obviously this reduced tax income for Uncle Sam means one of two things: less public services or higher taxes on the rest of America. I'd prefer just paying for it with cuts to Barney Frank's salary. But seriously, if the country actually wants to change the energy supply, then it's going to need to pay for it one way or another. At least this way the incentives are felt by both investors and the working man at the plant. When wind turbine techs stop paying taxes, eyebrows get raised. Hopefully the conclusion is that "these guys are doing a really important job for the country, and I'm happy to pick up the slack." Of course the other conclusion could be, "Let's kill this lucky bastard," but I have more faith than that.

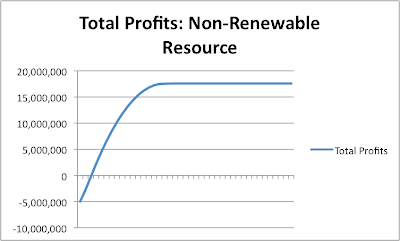

Still not buying it? Well I'm not much for handouts either. Here is the real reason why the government might want to incentivize renewables with short term tax breaks. When we combine revenue and cost into one curve we get profit. Long term profits are where the government can make its money (after payback period, government starts taxing again, and continues taxing through the long term):

3: Long Term Profits in a Non-Renewable Energy Project

4: Long Term Profits in a Renewable Energy Project

If you are a government with the long term in mind, then it's clear which projects offer you the most blood to leach. These projects happen to be the ones that don’t emit much greenhouse gas. They also happen to be the ones that don’t deplete unsustainably. Give 'em a tax break now, and you can ride the wave forever.

This idea came from trying to think about how to leverage the strengths (and preferences) of government and private investors: long term and short term investments, respectively. Now, I admit that my handle on business tax code is pretty limited. If what I'm proposing makes no sense, then please leave me some scathing commentary so that I can retreat into the Icelandic hills. I'm working now to get real data from energy companies here in Iceland and back home in the States. I want to reproduce these charts to reflect reality. The only way to find out if I am right is by comparing my ideas to real numbers...